Mushroom Psilocybe Cubensis / Psilocybe Cubensis Australia Map

Psilocybe Cubensis Australia Map, Mushroom Psilocybe Cubensis or Psilocybe Cubensis Australia for sale is available at our Magic Mushroom Store Australia. We have gone further to make magic mushroom users in Australia enjoy variety of Psilocybin Mushrooms Australia or Magic Mushrooms in Australia products like; Dried Magic Mushrooms Australia like the golden top mushroom or gold top mushroom, Magic Truffles Australia, Microdosing Australia, Shroom Edibles Australia or Magic Mushroom Edibles Australia. Again, if you wish to grow Psilocybin Mushrooms in Australia, Magic Mushrooms in Australia or Psilocybe Cubensis Australia, we have available Magic Mushroom Grow Kits Australia or Mushroom growing Kits Australia, Magic Mushroom Spores Australia or Mushroom Spores Australia and Magic Mushroom Spore Syringes Australia. These our Magic Mushroom Grow Kits Australia will help you grow high graded Australian Magic Mushies, Psilocybe Cubensis Australia Map. Psilocybin Mushrooms Australia. If you are looking on where to Buy Magic Mushrooms In Australia, or Psilocybe Cubensis Australia for sale. Our Magic Mushrooms Store has vou covered.

FEATURED PRODUCTS

BEST LSD PRODUCTS IN AUSTRALIA

EXPRESS SAFE DELIVERY IN AUSTRALIA

Buy LSD Online Australia – lsd for sale in Australia– order lsd online Australia . lysergic acid diethylamide (lsd), also known as acid, is a hallucinogenic drug. effects typically include altered thoughts, feelings, and awareness of one’s surroundings. many users see or hear things that do not exist.

FEATURED PRODUCTS

Blue Dream Delta 9 Gummies

Crescent Canna Moons Delta 9 Gummies 12mg THC 5mg CBD

Delta-9 THC Gummies

Kiwi Burst Delta 9 Gummies

Mango Crush Delta 9 Gummies

Pink Lemonade Delta 9 Gummies

Sour Worms Delta 8 Gummies

What Do We Offer At Our Psychedelics Store?

FEATURED PRODUCTS

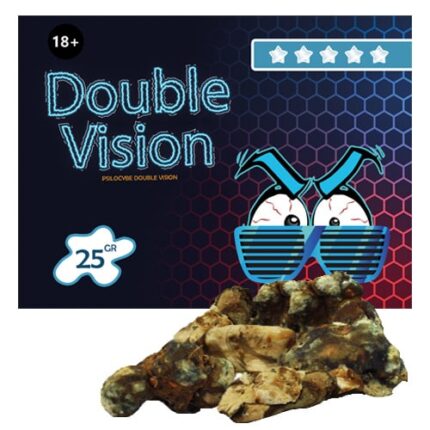

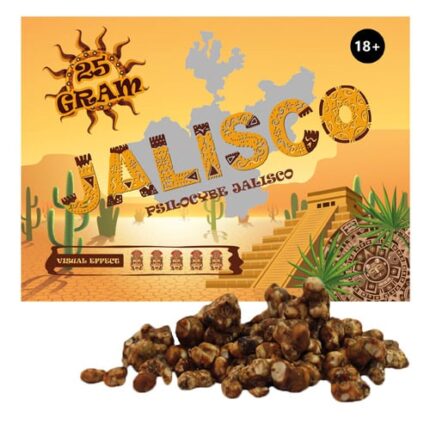

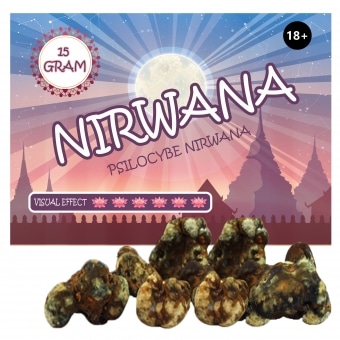

Buy Mushroom Truffles Australia

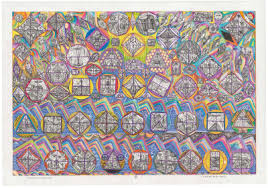

Magic Truffles contain the psychoactive compounds psilocybin and psilocin, which can cause hallucinations, changes in perception, and altered thinking and emotional states when consumed. Magic Truffles are often used for spiritual or therapeutic purposes

Delivered ready-to-eat to your door, we have a wide variety to choose from — check out the full range here!

MAGIC MUSHROOM GROW KITS | BUY AND GROW MUSHROOM

Our selection of grow kits offers something for everyone. If you’re new to magic mushrooms, try out one of our less potent strains for a gentle introduction. In contrast, you’ll need something a little stronger if you want to blast off and explore alternate dimensions. You’ll get a general idea of the potency of each strain by reading the description of a particular grow kit.